IPO Readiness

Is your brand IPO ready?

A few months before the IPO, it suddenly hits the executive committee: “What do we do about branding?” Branding mistakes during an IPO are expensive. A brand that is positioned too low reduces market capitalization by billions. A company name that is not protected or protected too late can lead to legal disputes – in the worst case to loss of the name. And a lack of internal prospects may cause talent to leave even before the IPO.

Challenges in IPO branding

An IPO or carve-out of a business unit does not only involve complex legal aspects but also challenges for brand management. Far-reaching questions have to be answered under extreme time pressure, under strict confidentiality. A structured IPO or carve-out branding process that addresses all relevant questions reduces risks and smoothens the way.

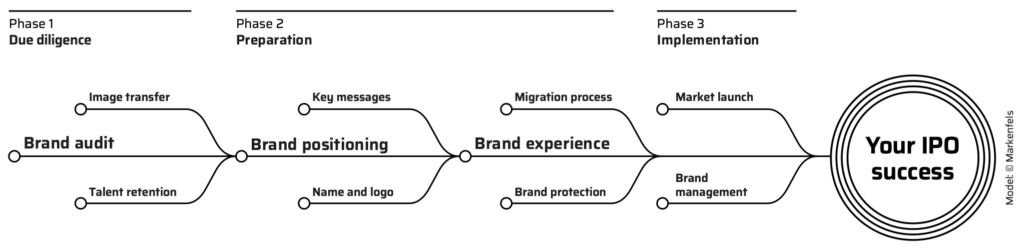

The Markenfels IPO Brand Navigator©

The Markenfels IPO Brand Navigator© is a safe, structured branding process to prepare the corporate brand for the IPO. The process can be used to strengthen an existing corporate brand – or to develop a new brand in the event of a carve-out.

The Markenfels IPO Brand Navigator© prepares the corporate brand for the IPO.

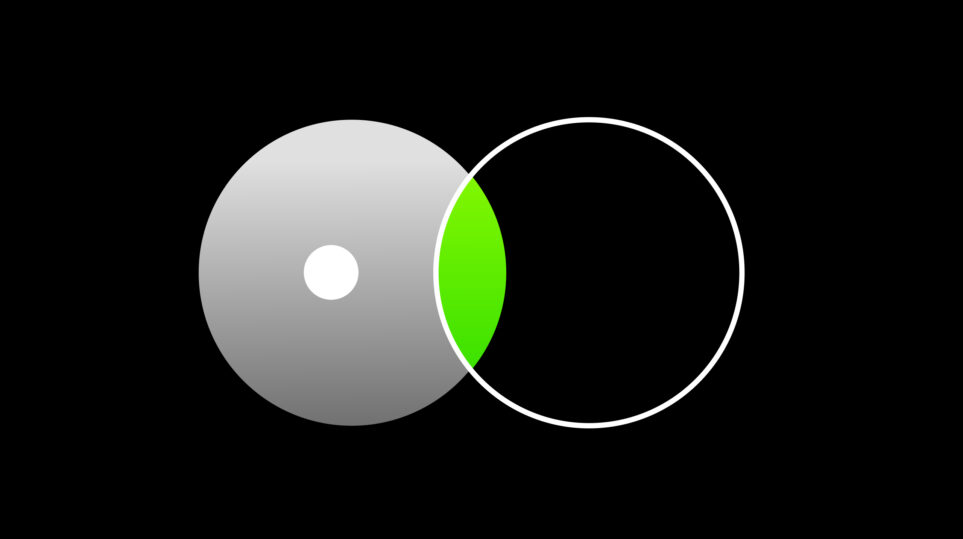

During the due diligence phase, a brand audit is recommended to clarify if branding supports the future business strategy and has the power to attract investors, talent, and new clients.

In the preparation phase, the brand positioning, key messages and, if necessary, a new name and logo are developed. The development of a new name must start at least 5 months before the IPO to allow legal brand protection. Development and registration each take 1 month, and the opposition period, during which a market participant can file an appeal, takes another 3 months. IP departments of many companies therefore register neutral names “in stock”. This reduces risks and saves time. During the preparation phase, the brand experience is also revised or newly developed.

In the implementation phase, the brand is launched to the market and ongoing brand management begins.

Key to success

In addition to broad experience in branding on both company and agency side, three factors are key to success in IPO branding:

- Early involvement of branding in the IPO process, ideally in the preparation phase for the IPO.

- Structured planning of necessary sub-projects along an immovable roadmap. This also includes a triage of requirements that must be resolved before the IPO for legal and communication reasons – and tasks that can be completed at a later stage.

- Super fast decisions on the company side.

IPO of an existing company

Which branding elements generally need to be implemented at the moment of an IPO? This depends on the form of the IPO. If an existing company goes public, it will already have all the necessary elements in place, such as name, logo and a corporate design. In such cases, an IPO is often used to make a statement both internally and externally through a brand refresh. This decision subsequently influences the branding roadmap.

If there is enough time, it is worth introducing a new brand experience a few months before the IPO – and using it for investor and talent communication.

IPO in the case of a carve-out

In the case of a carve-out, where part of a company is floated on the stock exchange as an independent company, the carve-out agreement sets out the mandatory branding elements to ensure that the two future companies can be clearly differentiated. These can be, for example

- A new, differentiating company name

- A new, differentiating logo

- A new, differentiating brand experience

- Preliminary implementation at defined touchpoints, such as website, business cards, stationery, PowerPoint, signage on-site, e‑mail sender

- etc.

As part of the carve-out agreement, a time frame of 6–12 months is usually set during which the company is still supported by the parent company and more complex touchpoints are rebranded step by step. These can be, for example

- Product branding

- Industrial design

- Packaging

- Apparel programs

- Vehicle fleets

- e‑Commerce applications

- etc.

Checklist for creating a new IPO ready company name

Quality checks

Availability checks

* These checks require support from specialized IP lawyers